Category:

Personal Finance

The Credit CARD Act of 2009 was supposed to help borrowers who do not work outside the home, but one interpretation is cutting the access those potential borrowers have to credit. One lawmaker describes this as a return to the “dark days” of lending when women were disenfranchised.

As millions of Americans struggle to keep up with monthly expenses in a tough economy, consumers in search of automobile loans are in for some good news: not only have…

What started as a legitimate attempt to prevent identify theft has instead resulted in a ripe opportunity for criminal activity. According to recent reports, for as little as $10, criminals…

To the delight of consumer advocates, several American banks will be discontinuing controversial add-on products such as payment protection and debt protection in the coming year. Bank of America After…

Recent consumer reports indicate there was a slight shift among Americans and their approach toward debt — and it seems to be affecting economic growth. According to a July 2012…

American consumers are doing their best to pay their bills and stay out of debt by using coupons to shrink costs. It’s working — but much more could be saved, experts say.

American consumers can’t seem to catch a break. It seems every time we look around, prices are going up. Bank fees are no different. MoneyRates.com recently found that banking costs…

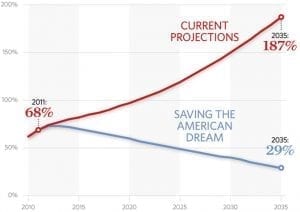

There’s no denying that a nationwide consumer debt crisis continues to wreak havoc on middle- and lower-class households. But those on opposing sides of the political spectrum disagree about how…

Conservatives and liberals agree that high levels of national consumer debt continue to deter financial freedom and stifle the economy as a whole. But those with opposing political views disagree…

What a difference a few years can make in the typical American household. The Federal Reserve recently announced that the median U.S. household lost nearly 40 percent of its wealth…