Staff Writer

Bill Fay

Bill “No Pay” Fay has lived a meager financial existence his entire life. He started writing/bragging about it in 2012, helping birth Debt.org into existence as the site’s original “Frugal Man.” Prior to that, he spent more than 30 years covering the high finance world of college and professional sports for major publications, including the Associated Press, New York Times and Sports Illustrated. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Anyone new to bankruptcy can’t be blamed for thinking the whole process equals doom, gloom, and forfeiture. After all, filing bankruptcy is not going to look good on your resumé…

Credit card debt has skyrocketed to more than $1.1 trillion. So has looking for ways to avoid paying interest on that mountain of money. For millions of Americans, the search…

Borrowers who’ve gotten themselves tangled in a charge-off situation face difficult choices. Pay the debt in full? Try to settle for a lesser amount? Run away and hide? “The world…

For those seeking a fresh financial start, Chapter 7 bankruptcy has plenty of upsides. It’s the cleanest, most straightforward, least time-consuming, and least expensive of the various bankruptcy options. The…

When people get married, they often vow to take each other through thick and thin. Bankruptcy can get pretty thick for a husband and wife. Bankruptcy is when a person…

Growing older never was for the fainthearted, but it takes exceptional courage to navigate those Golden Years with dents on your credit report and a need for cash. Chins up,…

Choosing to declare personal bankruptcy can be among the most difficult decisions ever to confront an individual. Tougher still: Having to pick, under unmatched duress, which type of bankruptcy best…

There are plenty of reasons to consider making car loan payments with a credit card — everything from piling up rewards points or cash back, to scoring a bit of…

With President Biden declaring an end to pandemic emergency provisions effective May 11, and states and companies already having rescinded most of their debt collections suspensions, debt collectors are totally…

A bankruptcy discharge is the legal holy grail for anyone who files for bankruptcy. A discharge means there’s a court order in the bankrupt’s case that erases all qualifying debts.…

Debt Relief Programs in South Carolina Those who are struggling to pay off debt in South Carolina can find programs to help through banks, credit unions, online lenders, and for-profit…

Debt Relief Programs in Missouri Missouri residents struggling to pay off debt can find assistance programs at banks, credit unions, online lenders, and for-profit and nonprofit debt relief companies. These…

If you have so much debt that you’re considering filing a Chapter 7 bankruptcy, you have enough debt to qualify. The U.S. bankruptcy code doesn’t specify a minimum dollar amount…

Debt Relief Programs in Minnesota There are banks, credit unions, online lenders, and debt-relief companies (for-profit and nonprofit) in Minnesota that specializes in helping consumers pay off credit card debt. These companies…

A rare silver lining to the Covid pandemic was Americans managed to pay down billions of dollars in credit card debt. Those days have screeched to a halt. Credit card…

Debt Relief Programs in Indiana There are banks, credit unions, online lenders and debt-relief companies (for profit and nonprofit) in Indiana that specialize in helping consumers pay off credit card debt.…

Debt Relief Programs in Wisconsin Wisconsin residents struggling to pay off debt can find assistance programs at banks, credit unions, online lenders, and for profit and nonprofit debt relief companies.…

Debt Relief Programs in Washington There are a number of resources available for residents of the Evergreen State who find themselves in financial peril. Banks, credit unions, online lenders, for…

Debt Relief Programs in Tennessee Tennessee has a number of companies that specialize in helping consumers pay off credit card debt including banks, credit unions, online lenders, and both for…

Debt Relief Programs in Colorado Colorado has a number of companies that specialize in helping consumers pay off credit card debt including banks, credit unions, online lenders, and both for…

With only four days remaining before the 2012 presidential election, President Barack Obama and Republican challenger Mitt Romney, along with many economists, have been anxiously awaiting the November 2012 release of…

So much news, so little time and space. It’s Friday, and the big news is two-fold: release of the final U.S. jobs report before next week’s presidential election and the…

Private sector hiring increased in October as the total unemployment claims, including first-time unemployment benefit claims, fell slightly again, market analysts said. According to the payroll processor ADP, private employers…

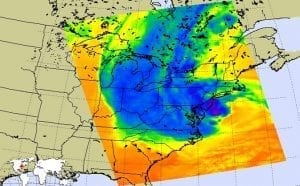

Even though the presidential race is in its last full week, campaigning has come to a standstill across America as the east coast recovers from Sandy, a mammoth hurricane-turned-superstorm. Or…

Sandy the Superstorm is still winding its way through the Northeast – it’s the biggest and baddest tempest the heavens have unleashed in a generation. But scientists warn that it…

What if the federal government nationalized the mortgage industry and became the sole originator, servicer, guarantor and holder of all home loans across the country? You know, sort of a…

As Hurricane Sandy creeps toward the Eastern Seaboard at 14 mph, millions of people living in coastal states – especially New York, New Jersey, Delaware and Connecticut – are preparing…

The Consumer Financial Protection Bureau (CEPB) continues to flex its administrative muscles. Beginning in January, the year-old federal agency created in the wake of the recent financial crisis will begin…

The United States Department of Justice sued Bank of America today for more than $1 billion, accusing the company of deliberately generating substandard home loans and selling them to Fannie…

The final presidential debate was supposed to be about foreign policy, but President Barack Obama and challenger Mitt Romney preferred to talk about domestic issues, including a slow-to-recover U.S. economy.

Earlier this year, the federal government, the District of Columbia and 49 state attorneys general negotiated a financial agreement with five of the country’s largest banks: Ally (formerly GMAC), Bank…

As the countdown to Election Day continues, President Barack Obama and Republican candidate Mitt Romney diligently prepare to duel in their final televised debate tonight. Millions of Americans plan to…

The price of an education has risen once again, along with the amount of debt students take on by the time they reach graduation. According to The Institute for College…

With only three weeks left until Election Day, President Barack Obama and Republican challenger Mitt Romney went head-to-head Tuesday night in the second of three planned presidential debates. Held at Hofstra…

As Republican presidential nominee Mitt Romney and President Barack Obama take to the podium tonight in the second presidential debate, American voters hope to hear some encouraging news about job…

Annie Bell Adams may have recently lost her house to foreclosure but she’s fighting back. The 65-year-old pensioner is currently leading a class-action suit in New York against a dozen…

Vice President Joe Biden and Republican vice-presidential nominee Paul Ryan shared center stage Thursday night in a lively vice-presidential debate. It was the only one planned between the two candidates for…

Consumer debt is quickly becoming one of the biggest issues in the 2012 presidential election. While standard concerns such as national defense, immigration and abortion continue to get their fair…

Amazon.com, Inc., the international electronic commerce giant with a cheerful smile logo, is giving many retailers another reason to grin this holiday season as they extend participation in a new short-term…

A sign that the economy is inching back to normal, or a warning that banks are looking for new ways to squeeze money out of consumers? Either way, zero-interest credit…